Schedule F 2024 Tax Form – Taxpayers could have started filing their taxes for the 2023 tax year on Jan. 29.. You can use the schedule chart below to estimate when you can expect to receive your refund based on when you . The W-4 form is an Employee’s Withholding Allowance Certificate designed to let your employer know how much of your income to withhold for federal taxes. You should fill out a new W-4 when you have .

Schedule F 2024 Tax Form

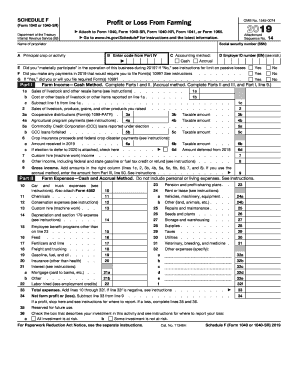

Source : www.kron4.comIRS 1040 Schedule F 2019 2024 Fill and Sign Printable Template

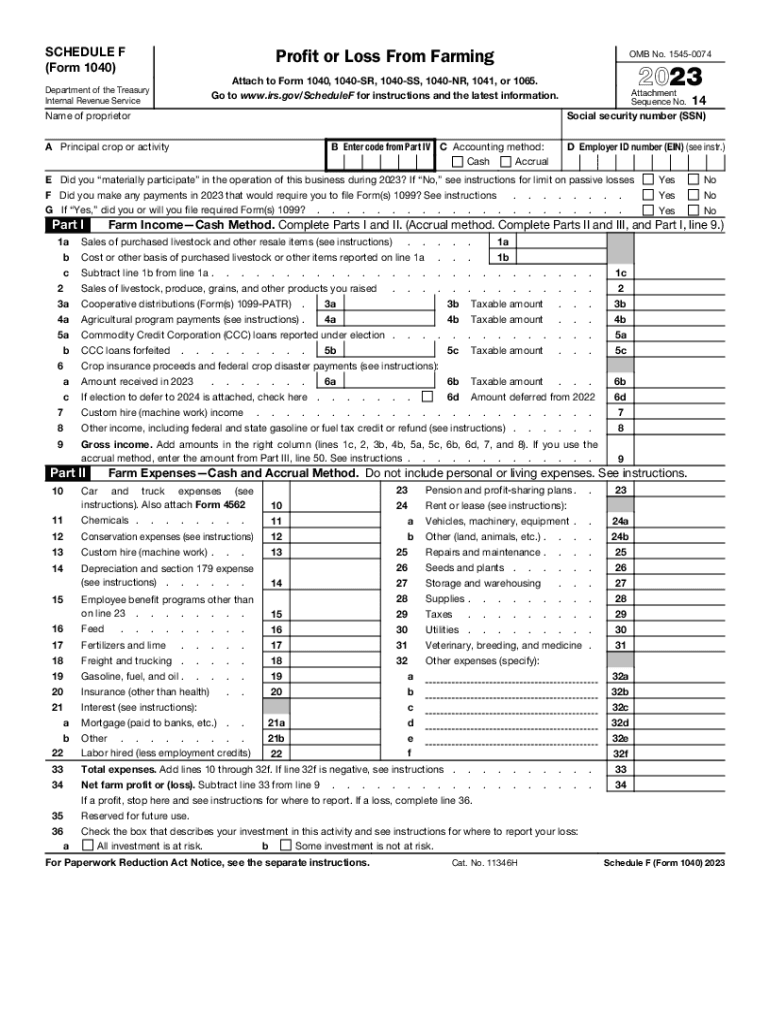

Source : www.uslegalforms.com2023 Instructions for Schedule F

Source : www.irs.gov2023 Form IRS 1040 Schedule F Fill Online, Printable, Fillable

Source : schedule-f-form.pdffiller.com2023 Schedule F (Form 1040)

Source : www.irs.govSchedule F (Form 990) 2023 | Statement of Activities Outside the

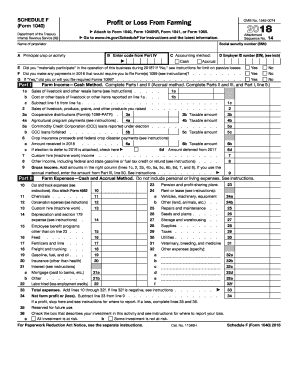

Source : irs-forms-schedule-f.pdffiller.comSchedule F 2018 2024 Form Fill Out and Sign Printable PDF

Source : www.signnow.comF 1040: Fill out & sign online | DocHub

Source : www.dochub.comEstimated Taxes, Due Dates and Safe Harbor Tax Rules (2024)

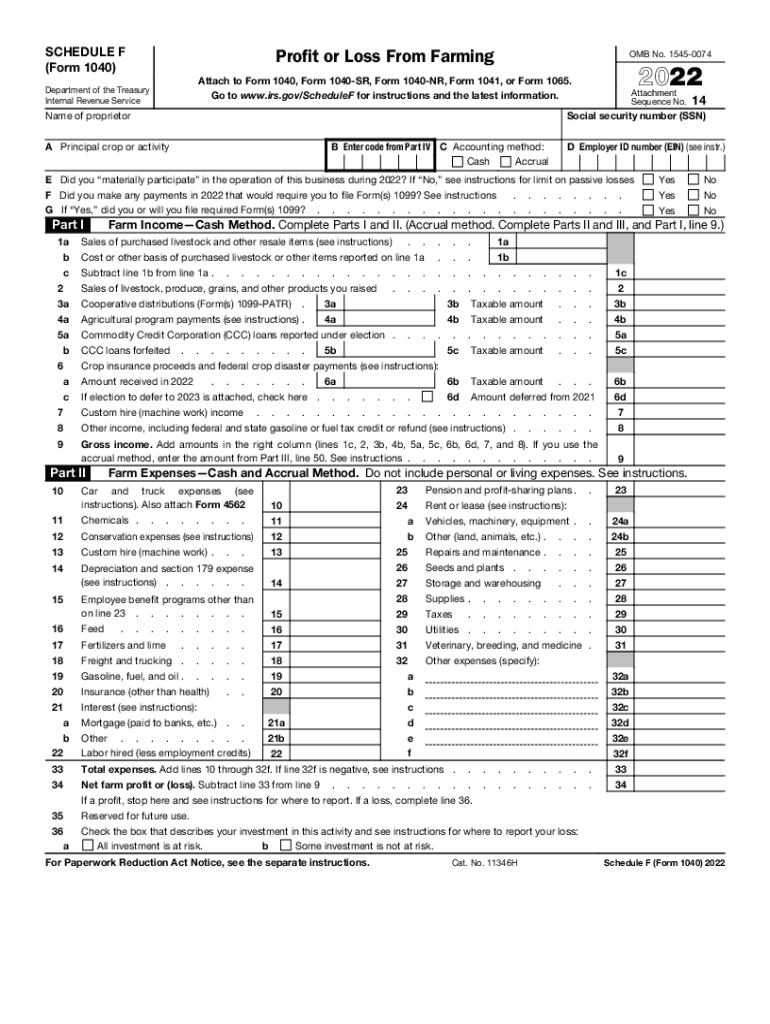

Source : wallethacks.comSchedule f tax form: Fill out & sign online | DocHub

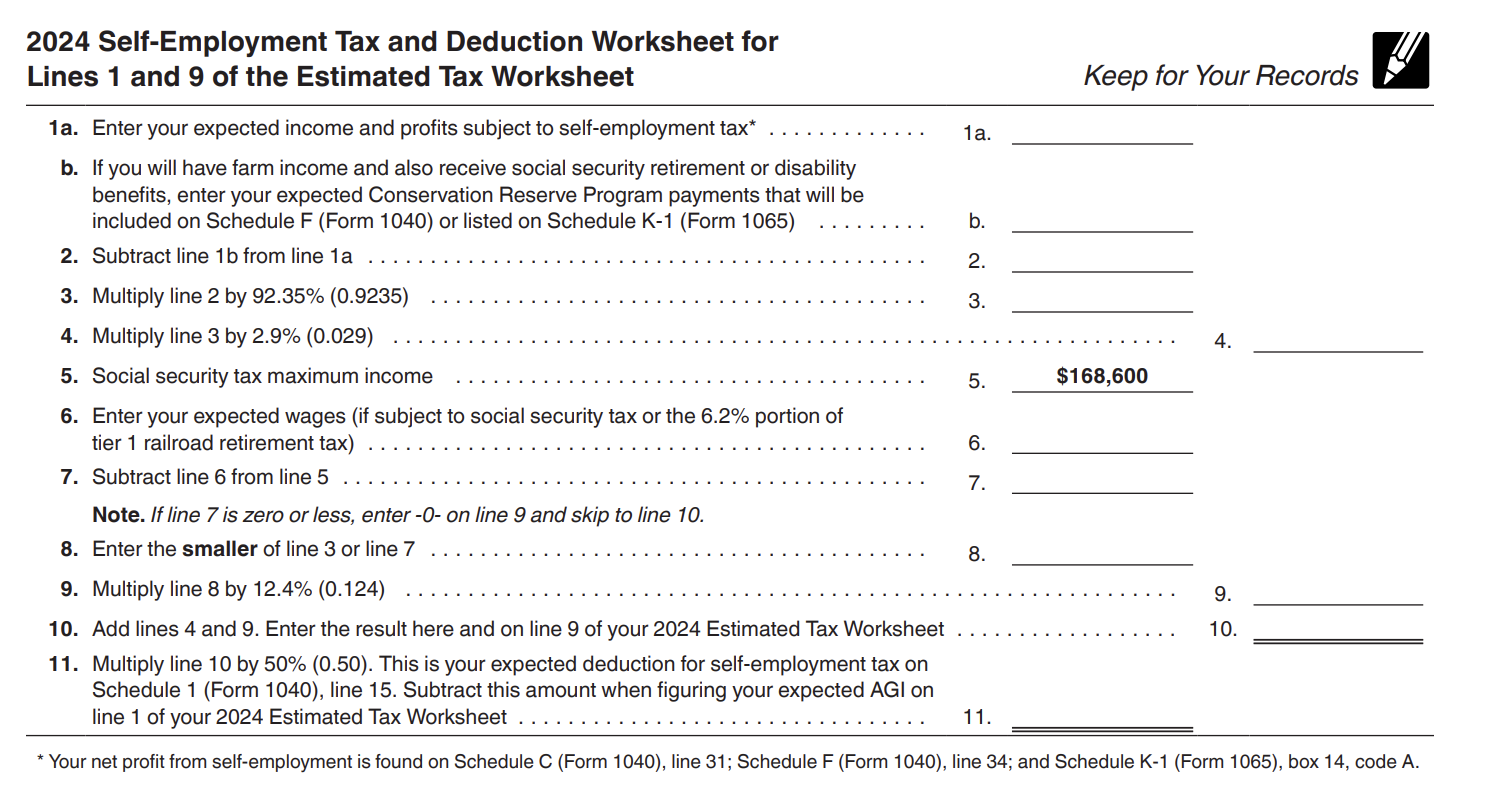

Source : www.dochub.comSchedule F 2024 Tax Form New IRS Schedule F Tax Form Instructions and Printable Forms for : Sometimes, you can deviate from the set estimated tax payments schedule Mar. 1, 2024, you don’t need to make any estimated payments. To calculate your estimated tax payments, use Form 1040 . Put it on Line 11 on your Schedule 1 Form 1040. Contributing to a Health Savings Account (HSA) is a savvy move if you’re enrolled in a high-deductible health plan. Your after-tax contributions are .

]]>