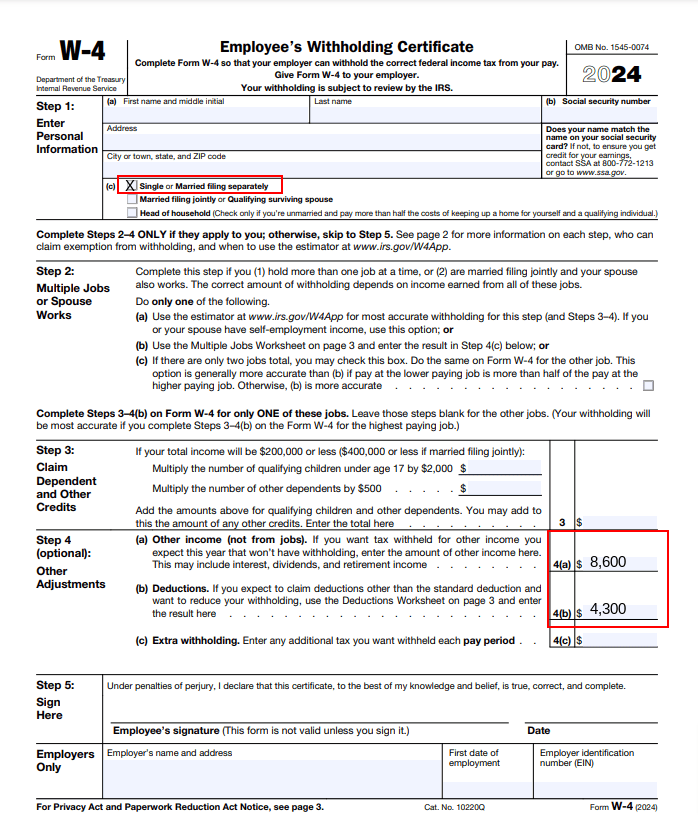

W 4 Federal 2024 – Don’t be alarmed, on average US tax refunds are 13% lower this year. Here are ways you can receive a bigger one. . The W-4 Form, issued by the IRS, is a critical document for determining the amount withheld from your paycheck for federal income taxes. Its accurate completion is essential to avoid either .

W 4 Federal 2024

Source : www.irs.govIRS Releases 2024 Form W 4R | Wolters Kluwer

Source : www.wolterskluwer.com2024 Form W 4P

Source : www.irs.govHere’s How to Fill Out the 2024 W 4 Form | Gusto

Source : gusto.com2024 New Federal W 4 Form | What to Know About the W 4 Form

Source : www.patriotsoftware.comHere’s How to Fill Out the 2024 W 4 Form | Gusto

Source : gusto.comW 4: Guide to the 2024 Tax Withholding Form NerdWallet

Source : www.nerdwallet.comW 4: Guide to the 2024 Tax Withholding Form NerdWallet

Source : www.nerdwallet.comHere’s How to Fill Out the 2024 W 4 Form | Gusto

Source : gusto.comPublication 505 (2023), Tax Withholding and Estimated Tax

Source : www.irs.govW 4 Federal 2024 Employee’s Withholding Certificate: To use the estimator, locate your paystubs and use them to enter your current state and federal withholdings. Yes. In the past, employees could claim allowances on their W-4 to lower the amount of . Federal Form W-4 is used to help employers collect information needed to take out the proper amount of federal income taxes from employees’ paychecks. What the employee enters on the form will affect .

]]>